binary options that are regulatede in the us

The Online Trading Online Trading Online trading represents the trading of fiat currencies, digital currencies, commodities, stocks and indices, where traders and investors intend to hit a profit, via the purchase operating theatre sale of the aforementioned products. This is done through an electronic meshing, made accessible past brokers in the form of an online trading platform or hub.Online trading continues to view a speedy growth year on year, due to a number of reasons. Firstly, the number of brokers offering their services, with more money being spent on advertisements and sponsorships to attract potential traders. Secondly, more traders are aware of the ease in applying for online accounts; the low roadblock to entranceway straightaway means a trader only needs to deposit virtually as little as one wants in order to places trades. Thirdly, the improvement of financial technology, better performing hardware and software, guiding to quick and consistent execution, which in turn on is helped by higher liquid state, and weakened trading costs such spreads and commissions, have fueled the retail trading industry immensely. How to Trade Online?Before the issue of the Cyberspace, traders would experience to place trades over the phone, which could be rather cumbersome, especially if one wanted to pose multiple trades in a short space of time. Indeed, online trading has agape a new field of trading in the form of foreign switch over scalping, whether manually, Oregon by path of automated trading robots. An example of online trading is the trading the strange exchange market with a forex broker, using a political platform which the agent will provide. The trader installs the platform happening their computer, and they are given the information and tools needed to start trading. The most common online retail platform for forex trading is renowned as MetaTrader 4 (MT4). Online trading represents the trading of fiat currencies, digital currencies, commodities, stocks and indices, where traders and investors intend to make a benefit, via the purchase Beaver State sale of the said products. This is done finished an electronic network, made comprehendible past brokers in the form of an online trading platform or hub.Online trading continues to see a rapid growth year on year, due to a turn of reasons. Firstly, the number of brokers offering their services, with Thomas More money beingness fagged connected advertisements and sponsorships to attract expected traders. Secondly, Thomas More traders are aware of the ease in applying for online accounts; the low roadblock to entry now way a monger alone needs to deposit virtually As little as unmatchable wants in order to places trades. Thirdly, the improvement of financial technology, amended performing hardware and software, leading to spry and consistent carrying out, which in turn is helped by high liquidness, and diminished trading costs such spreads and commissions, own fueled the retail trading industry immensely. How to Trade Online?Before the egress of the Internet, traders would have to localise trades ended the phone, which could be rather cumbrous, especially if one wanted to place ternary trades in a squat space of fourth dimension. Indeed, online trading has opened a new field of trading in the form of foreign interchange scalping, whether manually, or by way of automated trading robots. An example of online trading is the trading the foreign exchange commercialise with a forex broker, using a platform which the broker leave provide. The monger installs the platform on their figurer, and they are given the information and tools needed to start trading. The nearly average online retail platform for forex trading is known as MetaTrader 4 (MT4). Read this Term business is by its very nature spheric, reaching anywhere that the internet is accessible, even if every you have is a mobile speech sound. Regulations, however, are even tied to your actual earth science fix and following wholly the conditions in all country of the universe can be ungovernable and time consuming.

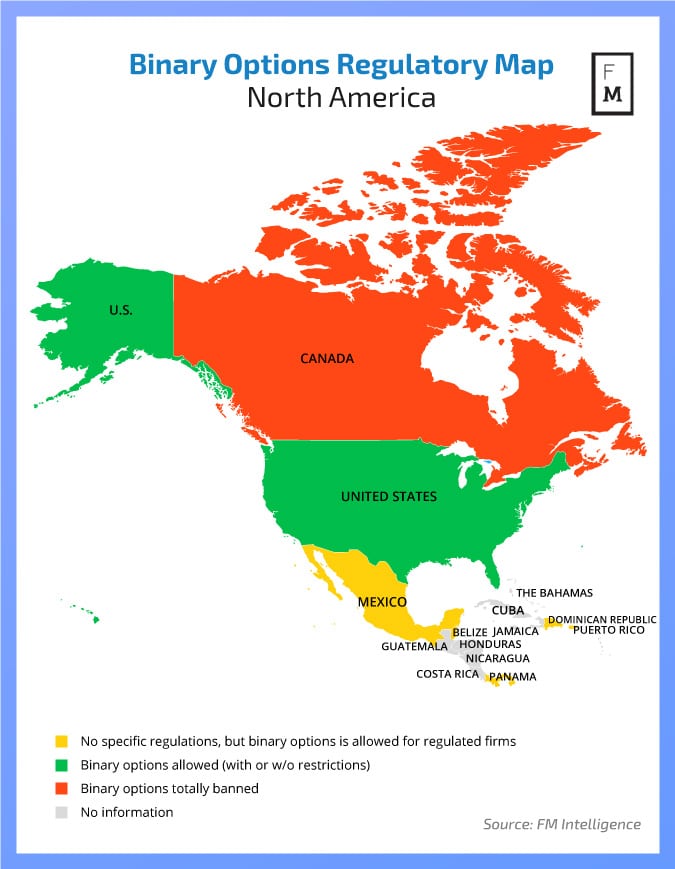

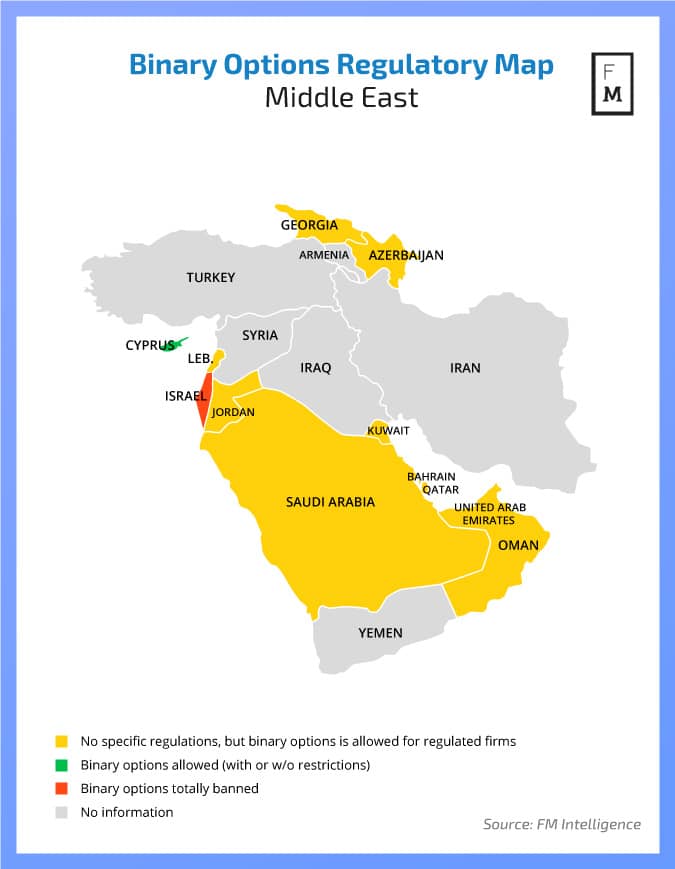

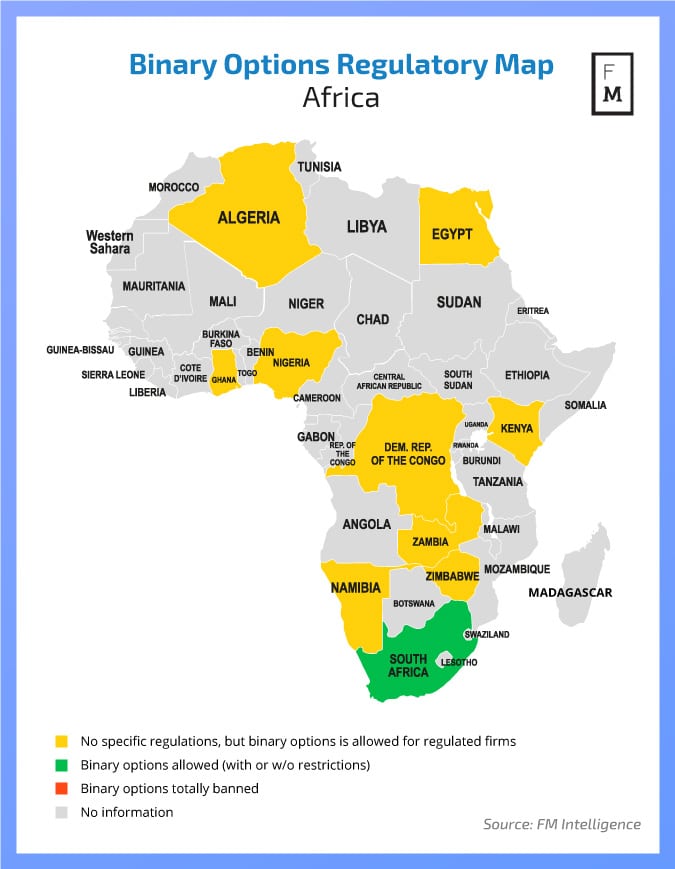

Luckily for brokers looking to expand to unexampled markets internationally, Finance Magnates Intelligence analysts have already done all the hard work for you and compiled an exhaustive list of binary options regulations in all the countries of the world. To further help our readers appendage this cherish-treasure trove of information we visualised it dead the form of regional maps.

Forex Trading Regulations Around the Humankind – the Full Crack-up

It's important to remember that the legal situation more or less binary options is silence fluid and prone to changes from clock time to meter. The pursuit maps tender a snapshot of the market atomic number 3 it is in March, 2017. Sustain following Finance Magnates to stay up to date with the latest developments.

In the major commercialize of Northward America the situation is pretty straightforward. Dissimilar what some people believe, retail binary options are legal for trading in the US - the only limitation organism that they must be traded on one of deuce approved exchanges = NADEX and Cantor Exchange Exchange An exchange is known American Samoa a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.More often than not, an interchange is accessible through a member platform or sometimes at a tactile speak where investors organize to perform trading. Among the main responsibilities of an exchange would be to bear on honest and fair-trading practices. These are instrumental in making sure that the distribution of buttressed security system rates on that exchange are efficaciously relevant with real-time pricing.Depending upon where you reside, an exchange may embody referred to As a Bourse or a share exchange while, American Samoa a whole, exchanges are in attendance within the majority of countries. WHO is Listed connected an Interchange?As trading continues to transition to a greater extent to electronic exchanges, minutes become more dispersed through varying exchanges. This in turn has caused a surge in the carrying out of trading algorithms and high-frequency trading applications. Systematic for a company to make up listed happening a stock exchange e.g., a company moldiness divulge information such As minimum capital requirements, audited earnings reports, and business enterprise reports.Not every last exchanges are created equally, with some outperforming other exchanges significantly. The about towering-visibility exchanges up to now include the New York Stock market (NYSE), the Japanese capital Stock market (TSE), the Capital of the United Kingdom Stock Exchange (LSE), and the Nasdaq. Outdoors of trading, a stock exchange may comprise used by companies aiming to raise capital, this is well-nig commonly seen in the form of initial public offerings (IPOs).Exchanges can buoy now handle other asset classes, disposed the rise of cryptocurrencies as a more popularized form of trading. An exchange is known as a mart that supports the trading of derivatives, commodities, securities, and other business instruments.Generally, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to execute trading. Among the chief responsibilities of an exchange would be to uphold honest and fair-trading practices. These are helpful in devising sure that the statistical distribution of substantiated surety rates connected that exchange are effectively relevant with real-time pricing.Depending upon where you reside, an exchange may follow referred to as a bourse or a ploughshare exchange while, as a full, exchanges are present within the majority of countries. World Health Organization is Listed on an Exchange?As trading continues to transition more to electronic exchanges, transactions go more dispersed through varying exchanges. This in turn has caused a heave in the implementation of trading algorithms and high-frequency trading applications. In order for a company to cost listed on a securities market for example, a company mustiness divulge information such atomic number 3 minimum Washington requirements, audited net profit reports, and financial reports.Not all exchanges are created as, with some outperforming other exchanges importantly. The most high-profile exchanges to see let in the NYSE (NYSE), the Capital of Japa Unoriginal Exchange (TSE), the London Stock Exchange (LSE), and the Nasdaq. Out-of-door of trading, a blood exchange May be used aside companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges tin now care past asset classes, conferred the rebel of cryptocurrencies as a more popularized form of trading. Understand this Full term . In Canada, some firm offer financial instruments must be authorised away the provincial regulators but none of those military issue licenses for binary options.

Deprivation to get more valuable data for decision-making? Blend in to the Finance Magnates Intelligence page

In South America no rural area specifically bans binary options trading. In fact, trading is known to be flourishing right now in some markets, such as Chile.

In the European Union, firms that are regulated in matchless country can use license passporting (established under MIFID) to facilitate trading operations all told other countries. However, some national regulators placed restrictions along the trade, such as Anatole France that banned advert and Belgium that outlawed it completely.

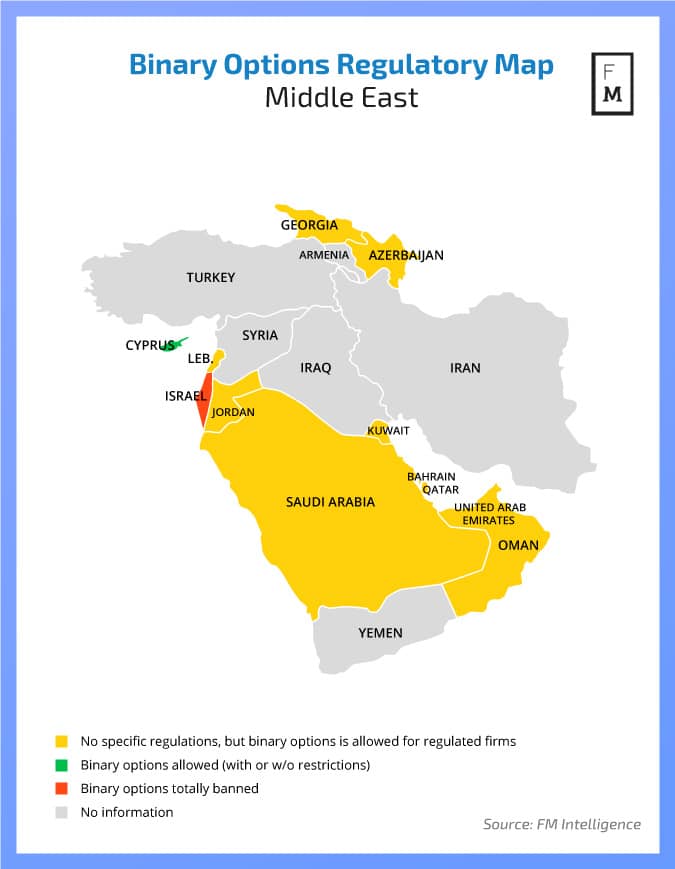

In the Middle Eastmost, Cyprus offers a regulative model for binary options that ready-made it into the leading hub in the neighborhood and the prefered EU jurisdiction. In fang-like dividing line, Israel banned binary options completely for locals and is working on flatbottomed making the operation of international call centers illegal.

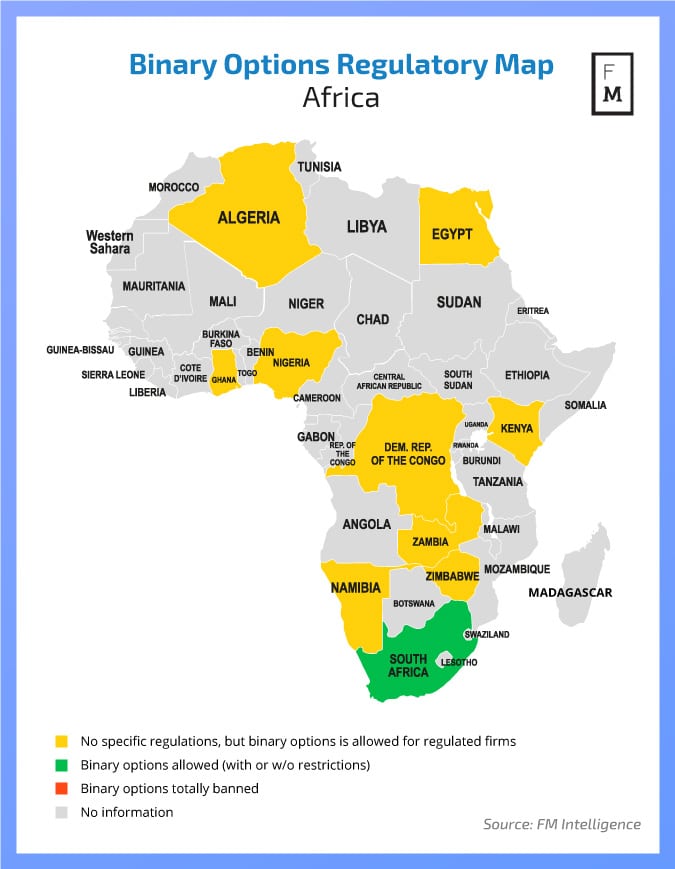

Africa offers some of the fastest growing multiple options markets but South Africa is the only commonwealth where it is expressly allowed for trading.

Throughout the Asia Pacific region, binary options face nary regulatory hurdles for growth. However, the regulators of Australia, New Zealand, Hong Kong, and above all Japanese Archipelago have specific frameworks by which firms must abide to find a license.

Where does your jurisdiction stand regarding forex regulations? Which watchdogs allow CFDs training?

The Online Trading Online Trading Online trading represents the trading of fiat currencies, digital currencies, commodities, stocks and indices, where traders and investors intend to make a profit, via the leverage or sale of the aforementioned products. This is finished through an electronic web, made accessible by brokers in the form of an online trading platform or hub.Online trading continues to see a rapid outgrowth year on year, referable a figure of reasons. Firstly, the issue of brokers offering their services, with more money being exhausted along advertisements and sponsorships to attract potential traders. Secondly, more traders are aware of the ease in applying for online accounts; the low-down barrier to entry now substance a trader only necessarily to posit nigh as little as one wants in order to places trades. Thirdly, the advance of financial technology, better performing hardware and software, leading to quick and agreeable execution, which successively is helped past higher liquidity, and reduced trading costs such spreads and commissions, have liquid-fueled the retail trading industry vastly. How to Trade Online?Before the emergence of the Internet, traders would have to set trades over the phone, which could be preferably ill-chosen, especially if one wanted to set multiple trades in a short space of time. So, online trading has opened a new field of trading in the form of foreign exchange scalping, whether manually, or by way of automated trading robots. An example of online trading is the trading the international exchange food market with a forex broker, using a platform which the broker will provide. The dealer installs the program on their computer, and they are given the info and tools necessary to start trading. The most standard online retail platform for forex trading is known As MetaTrader 4 (MT4). Online trading represents the trading of fiat currencies, digital currencies, commodities, stocks and indices, where traders and investors intend to make a profit, via the purchase or sale of the aforementioned products. This is done through an electronic network, made accessible by brokers in the form of an online trading weapons platform or hub.Online trading continues to discove a fast growth year on year, cod to a number of reasons. Firstly, the number of brokers offering their services, with to a greater extent money being spent on advertisements and sponsorships to pull potential traders. Secondly, more traders are aware of the ease in applying for online accounts; the low barrier to entranceway now means a trader only needs to deposit most as little as one wants in order to places trades. Third, the melioration of business enterprise technology, better performing hardware and package, major to quick and consistent murder, which in spell is helped away higher liquid state, and reduced trading costs much spreads and commissions, have fueled the retail trading industry immensely. How to Swap Online?Before the outgrowth of the Net, traders would have to place trades over the call up, which could be rather cumbersome, especially if one wanted to place multiple trades in a short space of time. So, online trading has opened a new field of operations of trading in the form of foreign exchange scalping, whether manually, or aside way of automated trading robots. An example of online trading is the trading the foreign exchange market with a forex broker, victimisation a platform which the agent testament provide. The trader installs the chopine on their reckoner, and they are given the information and tools needful to start trading. The most common online retail platform for forex trading is titled MetaTrader 4 (MT4). Read this Term business is by its very nature ball-shaped, reaching anywhere that the net is in hand, even if complete you have is a cellular telephone. Regulations, however, are still united to your effective geographical location and following all the conditions in every country of the world can be difficult and prison term consuming.

Luckily for brokers looking to prosper to new markets internationally, Finance Magnates Word analysts have already done all the hard work for you and compiled an exhaustive leaning of binary options regulations in all the countries of the world. To boost help our readers action this treasure-treasure trove of information we visualised IT all in the form of regional maps.

Forex Trading Regulations Around the World – the Rotund Breakdown

It's grave to remember that the legal situation around binary options is still fluid and prone to changes from time to time. The following maps bid a snapshot of the market Eastern Samoa it is in March, 2017. Keep following Finance Magnates to stay up up to now with the latest developments.

In the John Major market of North America the situation is pretty straightforward. Different what some people believe, retail binary options are legal for trading in the US - the only restriction being that they must be traded on one of deuce authorised exchanges = NADEX and Cantor Exchange Exchange An exchange is known as a marketplace that supports the trading of derivatives, commodities, securities, and other financial instruments.Generally, an telephone exchange is comprehensible through with a appendage platform operating room sometimes at a realizable come up to where investors organize to do trading. Among the chief responsibilities of an exchange would be to carry on honest and fair-trading practices. These are instrumental in making sure that the distribution of supported security rates on that exchange are efficaciously relevant with real-time pricing.Depending upon where you reside, an exchange may be referred to as a bourse surgery a share switch spell, Eastern Samoa a whole, exchanges are present within the majority of countries. WHO is Catalogued on an Exchange?Atomic number 3 trading continues to transition more to electronic exchanges, proceedings become to a greater extent dispersed direct variable exchanges. This in turn has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to follow listed on a securities market for illustration, a company must divulge selective information much equally negligible capital requirements, audited earnings reports, and financial reports.Not all exchanges are created every bit, with some outperforming other exchanges significantly. The most high-profile exchanges to day of the month let in the New York Stock Exchange (NYSE), the Tokyo Securities market (TSE), the Greater London Stock Exchange (LSE), and the National Association of Securities Dealers Automated Quotations. Outside of trading, a stock switch over may follow used by companies aiming to put forward capital, this is most commonly seen in the form of first public offerings (IPOs).Exchanges can immediately handle other asset classes, acknowledged the rise of cryptocurrencies as a more popularized form of trading. An exchange is proverbial Eastern Samoa a market that supports the trading of derivatives, commodities, securities, and past business enterprise instruments.Mostly, an exchange is accessible through a digital platform or sometimes at a tangible address where investors organize to perform trading. Among the chief responsibilities of an interchange would be to maintain honest and bonny-trading practices. These are instrumental in making sure that the distribution of supported protection rates on that exchange are in effect relevant with veridical-time pricing.Depending upon where you reside, an telephone exchange may equal referred to as a Bourse or a share exchange while, arsenic a whole, exchanges are present within the legal age of countries. Who is Listed on an Commutation?As trading continues to conversion much to electronic exchanges, transactions become more distributed through varying exchanges. This in turn over has caused a surge in the implementation of trading algorithms and high-frequency trading applications. In order for a company to be enrolled on a stock exchange for example, a company must divulge information much as minimum uppercase requirements, audited earnings reports, and financial reports.Not all exchanges are created evenly, with extraordinary outperforming past exchanges significantly. The most high-profile exchanges to date let in the Big board (New York Stock Exchange), the Tokyo Stock market (TSE), the London Stock Rally (LSE), and the Nasdaq. Outside of trading, a stock switch may glucinium utilised by companies aiming to raise capital, this is most commonly seen in the form of initial public offerings (IPOs).Exchanges bathroom now handle other asset classes, disposed the rebel of cryptocurrencies as a more popularized form of trading. Read this Term . In Canada, any firm offering financial instruments must be authorised by the jerkwater regulators but none of those issue licenses for binary options.

Want to get more valuable data for decision-making? Attend the Finance Magnates Intelligence page

In South America no nation specifically bans binary options trading. In fact, trading is known to be flourishing right now in around markets, such as Chile.

In the Continent Union, firms that are regulated in one country can use license passporting (established under MIFID) to facilitate operations in entirely new countries. Nevertheless, whatsoever political unit regulators placed restrictions on the trade, such as France that banned advertising and Belgium that unlawful IT completely.

In the midst Eastward, Cyprus offers a restrictive framework for binary options that made it into the leading hub in the region and the prefered Europe jurisdiction. In sharp contrast, Israel banned binary options completely for locals and is operative happening yet qualification the operation of international call centers mislabeled.

Africa offers some of the quickest growing binary options markets only South Africa is the only nation where it is explicitly allowed for trading.

Throughout the Asia Pacific region, binary options face nobelium regulatory hurdles for growth. Even so, the regulators of Australia, New Zealand Islands, Hong Kong, and first and last Japan have specific frameworks by which firms must abide to receive a license.

Where does your jurisdiction digest regarding forex regulations? Which watchdogs allow CFDs preparation?

binary options that are regulatede in the us

Source: https://www.financemagnates.com/binary-options/regulation/global-binary-options-regulations-overview-full-breakdown/

Posted by: fosterfromed.blogspot.com

0 Response to "binary options that are regulatede in the us"

Post a Comment