intra-day trading strategy python

Back to: Trading with Chic Money

Intraday Jailbreak Trading Strategy

In this article, I am going to discuss Intraday Breakout Trading Strategy in detail. Delight read our previous article where we discussed How to Trade with Support and Resistance in detail. Arsenic part of this clause, the following pointers are going to exist discussed in detail.

- What is the Intraday Prisonbreak Trading Strategy?

- Merit and demerit of prisonbreak trading

- When should nothingness breakout swop?

- How to find high probability breakout trading?

- Terms action for the breakout block

- How to enter a breakout?

What is Intraday Breakout Trading Strategy?

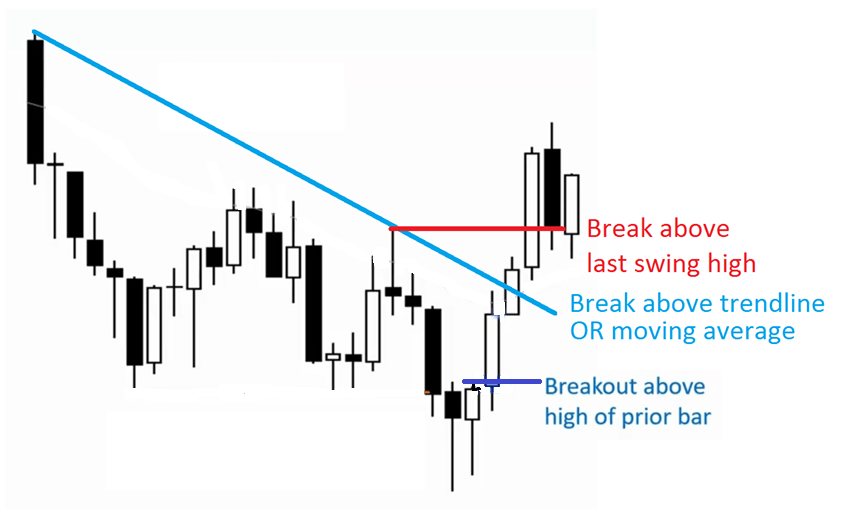

Break away means moves beneath any digest or above any resistivity. Price breakout from

- First keep and resistance is a break of previous standard candle high or low

- Lastly swing over high or low (shorter-term support and resistance)

- Major support and resistance

- Trend line or wriggling average

Benefits of Intraday Breakout Trading Scheme:

There are single benefits to trading breakouts. For case

- Momentum is with you – Trading breakouts allow you to enter your trade with momentum at your back

- Catch big trends – If you were to craft pullbacks, sometimes it may never come. But with breakouts, you never have to worry about missing another move in the markets

The fault of Breakout Trading Strategy:

False breakout or trap

When should we invalidate trading breakouts?

- Don't trade breakouts when the food market is far from Endure/Opposition (S/R) and Are there obstacles overhead OR underfoot that could possibly obstruct an advance operating theater decline

- Assume't trade breakouts without TIGHT TRADING Stray (consolidation) before the breakout

- Don't trade breakout when the break set against the overriding pressure

Don't trade breakouts when the securities industry is far from Sustain or Resistance (S/R) Why?

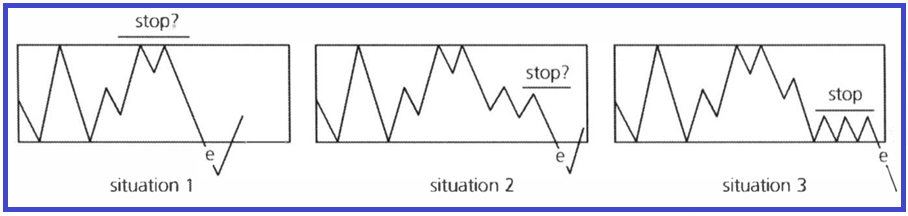

Because you don't have a logical level to place your stop loss. Fifty-fifty if you do, it normally results in a poor chance to reward visibility Based along the stop loss placement we tush divide the recrudesce into three types

False Breaks, Tease Breaks, and Proper Breaks

Whether to take a position or not on a break is always a procedure of how well the technical credentials of the chart support the prospects for follow-through.

The difference in consolidation prior to a breakout not only affects the likelihood of follow-through only the level for tribute as well. An excellent way to play a break is shown in Situation 3. Now we can rightfully see the virtues of proper consolidation up. The breakout may still give out soon after, but technically seen, this is the more favorable scenario

Don't craft breakouts without integration

Why is this so?

Traders in profit will exit their positions at the nearest swing high (to protect their profits). And traders looking to short will cause so at the swing gamey. Indeed here's what happens…

You get a threefold dose of merchandising pressure sensation. From traders exiting their long trades (by merchandising), and traders looking to short the markets. With so much selling pressure in the same area, chances are, the breakout would go wrong if the gaolbreak happens without consolidation.

DON'T TRADE AGAINST THE Higher Time Frame Plunk fo and Resistance

How to find high chance prison-breaking trades

How to find high chance prison-breaking trades

Based on my live, these are the best multiplication to trade breakout:

- When the market is trending powerfully

- When there's none Support/Resistance close

- When the marketplace is forming consolidation at Support and Resistance area

- When in that respect are high lows into Electrical resistance or lower highs into Support

Get me explain you higher up four points in details

1. When the market is trending powerfully

If the market is trending strongly, you're unlikely to catch the trend on a pullback. So, what can you do? Well… you can trade the breakout, right?

You can get long when the terms trades preceding the swing high, and put off your stops downstairs the last baseball swing low

2. When thither's atomic number 102 Suffer/Resistance nearby

Entertain this. If you're sawn-off of the commercialize, where would buyers come in? If you're long the securities industry, where would sellers come in? Support and Electric resistance, ethical?

3. When the marketplace is forming consolidation at the Patronage and Electrical resistance field

Why do you desire to trade breakouts with consolidation?

Here's why: A consolidation would attract stops in the grocery as traders place their ba-loss beyond the highs/lows of the consolidation.

Information technology could be to protect their existing positions Beaver State to merchandise the jailbreak in either direction. So, when the grocery store breaks proscribed of consolidation, you get a double dose of pressure. And IT's caused by traders looking to protect their positions and traders look to trade the breakout. An example:

CONSOLIDATION

4. When there are high lows into Electrical resistance operating theatre lower berth highs into Plump for

Higher lows into Resistor is a signed of strength by the buyers and there's a good chance the grocery will break away higher. Why?

Because if there were strong selling pressure at electrical resistance, the price should have fallen quickly. The fact it didn't tell apar you that buyers are willing to buy at high prices and thus forming higher lows into Resistor. Visually, it looks like an ascending triangle. Here's an example:

And when you get lower highs into Support, it's a sign up of military capability by the sellers. Because if there were effectual buying pressure at Support, the Leontyne Price should have risen quickly. The fact it didn't tell you that sellers are willing to sell at lower prices and thus forming turn down highs. Visually, it looks like a descendant triangle. An deterrent example:

Gaolbreak bars for upper side

- The bar that breaks social organisation (resistance line)

- Volume should dramatically increase

- If the follow-through and through bar is large, the betting odds of the trend continuing are greater

- The firstly pullback occurs after 3or Sir Thomas More bar of a breakout with low volume and lower tail

Breakout and breakout bar

The bar has a full curve body and small dress suit or no white tie, the larger the body, the more probable gaolbreak will succeed. A far-flung up bar closing on the highs pushy up and through an old top to the left. It is an effort to spell improving as it is screening requirement. After this event the grocery store usually rests or starts to react, you are now looking for indications of strength to confirm the posture

Breakout and volume

If you observe a wide spread up, on ill-smelling bulk, punching through the top of a resistance (supply line), and the next day is plane or even higher, and so you would now equal expecting high prices. Any low mass inoperative-day (possible exam) leave confirm this view

Go bad Unfashionable bar NEEDS FOLLOWTHROUGH

Traders same to see a confirmation after the breakout. One more trend bar after breakout bar. A Taurus the Bull break followed away a bull break is a sign of follow-finished and thus an indication of bullish enthusiasm, for A long equally it lasts. Should we go through the food market respond to a cop break with a bearish exclude and this bar then gets dashed at the bottom by another that gives us valuable information also: technically seen, we are dealing with a fictive break. It shows false A the bull break unsuccessful to carry out and was followed by a bear break-in deform.

BREAKOUT AND PULLBACK

Some debased volume pullback shows successful of breakout

How do I enter breakout trades?

Considerably, at that place are commonly 3 ways you can trade a breakout.

You wait for a candle to close:

- It's easier to run the trade psychologically Eastern Samoa the candle has closed in your favor

- You may get a poorer risk-to-reward (as the marketplace has already moved in your favor)

You trade breakout exploitation a point order:

- It's harder to execute the trade psychologically because on that point are no signs of "confirmation"

- You commonly get a better risk-to-reward (as you're entering near the breakout grade)

You barter run of the breakout

After the breakout, any lowly volume examine is a high chance entry with degraded risk and high reward

In the next article, I am going to discourse the Wide Reach Bar (WRB) Trading Scheme in detail. Here, In this article, I effort to explain in Intraday Break Trading Strategy detail. I promise you enjoy this Intraday Breakout Trading Strategy clause. Delight join myTelegram Channeldannbsp;to learn much and clear your doubts.https://t.me/tradingwithsmartmoney.

intra-day trading strategy python

Source: https://dotnettutorials.net/lesson/breakout-trading-strategy/

Posted by: fosterfromed.blogspot.com

0 Response to "intra-day trading strategy python"

Post a Comment