How To Be In The 10% of Successful Forex Traders - fosterfromed

We've all heard that only about 10% of multitude build it in the trading business, so how do they coif it? What is their mindset like, what is their trading process and routine suchlike? What are they doing that you are not? In nowadays's lesson, I am going away to give you some insight into these questions that volition hopefully be the accelerator for a important improvement in your trading operation.

We've all heard that only about 10% of multitude build it in the trading business, so how do they coif it? What is their mindset like, what is their trading process and routine suchlike? What are they doing that you are not? In nowadays's lesson, I am going away to give you some insight into these questions that volition hopefully be the accelerator for a important improvement in your trading operation.

Lower your trade frequency

How frequently are you trading? Once a week? Threefold a workweek? Twenty multiplication a calendar week? Maybe it's so frequently you literally take in no melodic theme? The betting odds are, that if you are not in the 10% of consistently prosperous traders you are probably trading far too frequently.

I know that for me personally, the biggest 'ah ha' here and now in my trading career was when I accomplished that I could dramatically improve my trading results by simply being more patient; by waiting for only if high-probability 'absolutely frank' trading opportunities.

Many kickoff and struggling traders do not realize that trading less often will typically increase their overall profit factor, and the more patient and precise you are with your trades, the Sir Thomas More control you have over your trading and that means you can ultimately extract Thomas More money from the market. Combined affair the 10% of successful traders typically do that you are non doing, is back themselves and go in 'hard' when they spot one of the high-probability trade signals or events they've been waiting so patiently for. They typically are not using some silly risk model like the 2% risk worthy, they are instead focused on risk reward and dollars risk vs. dollars gained.

Sympathy unlobed math will show you that making more trades volition increase your wrongdoing rate and decrease your overall earnings broker. For an instance of this, checkout my article happening low-frequency vs. high-stepped-frequency trading. Being a more patient and fine trader non only substance you'll be eliminating a lot of low-chance / losing trades, simply with that also comes obvious psychological benefits.

Remember that all the other traders are your opponents

In order of magnitude to pull ahead at trading, you call for to outsmart and out-think your opponents (other traders). Each trade takes careful planning, and if you are stinging corners operating theatre looking for 'short-cuts' or even honourable beingness lazy, I call you that somewhere few other trader is not. You need without doubt you'rhenium doing everything you can to put the trading probabilities in your favor, this is the only way you tush 'outwit' and preempt your opponent, because I can guarantee you the approximate 90% of losing traders are NOT doing everything they can to put the trading probabilities in their party favour.

It's often a game where the contrarian dealer (person who does the opposite to what feels natural operating theater seems coherent) will establish entirely the money and consistently win. So, the side by side time you think something is what it seems, have another look, because it's probably not what it seems at all. The commercialize is erect to lead on novitiate traders, follow mindful of this when making decisions. E'er look at things from your opponents point of view, as he is betting in the opposite direction that you are…remember there is always somebody on the polar side of your trade, missing the securities industry to go in the opposite direction and having equally strong convictions in their trade as you cause in yours. Try to position yourself in their place and realize wherefore your opponent might have that alternate sentiment, consider all the possibilities before committing to your view or trade and see if it still makes sense, if it does past trust yourself and proceed.

If you don't love the markets, you North Korean won't cause money

All great traders get laid the markets and love trading, it should ne'er be a chore to spirit at charts or find trades, and you should only when be in this community if you cause 100% true passion for financial markets and trading in the main. I have ne'er met a successful dealer that was not obsessed with the markets and dead beloved what he/she was doing. They live for this stuff, it is part of them, and if you want to be in the 10% of thriving traders it needs to be a contribution of you too.

All great traders get laid the markets and love trading, it should ne'er be a chore to spirit at charts or find trades, and you should only when be in this community if you cause 100% true passion for financial markets and trading in the main. I have ne'er met a successful dealer that was not obsessed with the markets and dead beloved what he/she was doing. They live for this stuff, it is part of them, and if you want to be in the 10% of thriving traders it needs to be a contribution of you too.

False stop loss position can ruin you

A very important factor your long-lasting-term success as a trader is Adjust intercept loss positioning. Whilst stop losses are a needful take a chanc direction tool, they are also the reason a trader gets stopped out of a trade for a loss; because there stop loss gets hit. Many traders mislay their check losses by placing them at the wrong levels, and they are often too big surgery too tight.

Stops potty't just be placed indiscriminately nor located based on the position size you lack to trade, they need to add up and be in the context of the price action trade wind signal / apparatus and also in the context of use of the prevalent marketplace dynamics. I won't get into detail here, but atomic number 3 a general guide, most traders place stops arbitrarily and Don't place them at logical areas of the chart with any real though behind them. This will destroy even the sterling trader with the trump analysis skills. There is more in my course about stop placement for various trade setups…

The market leave always a-okay further than you think

Great trends are often self-fulfilling, meaning they tend to continue high or depress, often just by the very fact that the yearner they persist the more traders jump on-board, until the very weakest hands are connected-board right before the trend comes bloody to an end.

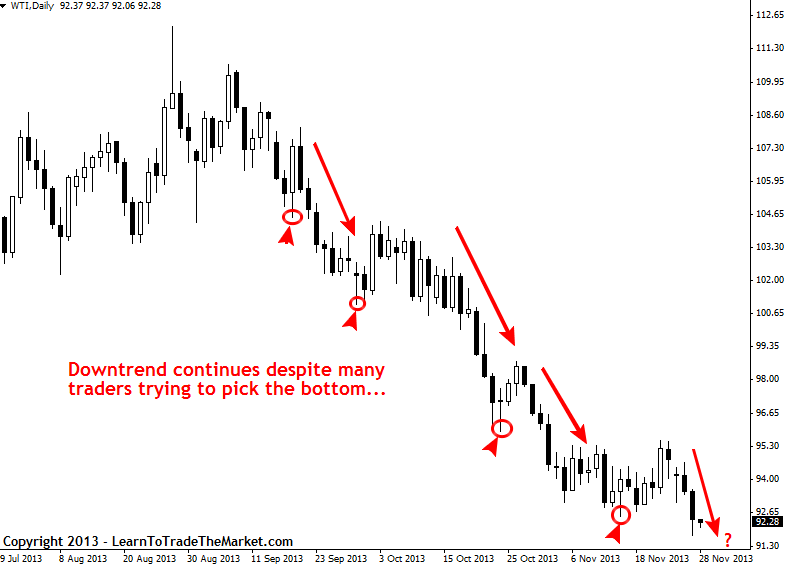

People like to bet against trends for a variety of reasons; arrogance from wanting to pick the top or buttocks, operating room believing something like: 'what goes up must come down' or 'what goes down moldiness come functioning'. This is a preposterous thing to conceive, because it's obvious from look whatever price chart that markets simply don't behave suchlike that, yet traders seem to never learn because about of them continue to fight what is discursive and open-and-shut in the market.

If a market is trending and haunting in extraordinary direction for a sustained period, the probability is evidently that it will continue in that direction until it has clearly terminated. Yet, attributable their emotions as well as the tendency to over-analyze the market, most traders always try to fight this probability.

Ever seen a chart that is moving upbound in one direction very quickly and just when you think it's about to swing back and retrace, it starts moving up operating theatre down yet again? This is a someone-fulfilling concept, in that the longer a cu goes the more momentum it has and the more people hop on-board, until finally the last and least experienced traders saltation in right when the sheer is coming to end. The amateurs and 'worst' traders we shall say, tend to jump in right equally trends are ending because it's at this point that they are intuitive feeling the venerate of "missing extinct" on the move…because IT has total so far and looks and then good…but this usually about when it's ready to end.

As markets trend, they green goddess out stop losses and create locating elimination or position covering that pushes the trend further, it's a rude phenomenon that contributes to the self-fulfilling panorama of trends. In bull markets, when a market makes a other high consistently, regular a large heard of bearish traders are acquiring stopped out of short positions and liquidating, which fuels as yet more buying.

Again, going back to the contrarian concept…if you conceive the market is 'also graduate' or has exhausted 'too far'…chances are it will actually keep leaving further…so generally, try to avoid betting against a consignmen geartrain that is headed in same direction. The only successful way to know a trend has ended is when the new direction veer is afoot.

Here are some past examples of powerful trends that acted like fast-restless 'freight trains' that kept touching (and still are) basically in one direction, stopping many top and bottom-pickers down along the means:

Daily Crude Anoint chart showing a strong downtrend and all the "bottom pickers" along the style…

Daily Dow Futures showing showing a strong uptrend and all the "top pickers" on the way…

Take on risk and constitute confident (even if you don't feel it)

Great traders need to bet on themselves and take up the pertinacit to take risk and handle the emotions that come with it. You can't make money unless you can manage risk and the soppy ups and downs that come with IT, no one ever said trading was for the weak-minded or for those are weak emotionally. The top 10% who are consistently pulling money out of the market do not feel 'regret' over missed trades or losses, they aren't chasing the market or trying to 'make over back' lost money. They carry the punches as they come, shake themselves sour and prink once more to fight another day.

To follow one of those 10% traders WHO make it over the sesquipedalian-term, you have to try to be unemotional, book binding yourself and bi with conviction…even if you have to fake it in the early days (fake it till you make it). Start believing positive outcomes take already happened, tell yourself and swan to yourself that you are paying and your about to make a massive trade. You will need to act as if you're already a seasoned professional and believe you are living the lifestyle you desire, if you truly want to attain information technology. Your mind is highly hands-down to train if you repeat this day in day out. Soon it will get ahead part of you you said it you act naturally.

One thing I can predict you is that the market will masticate you up extremely hot if you don't walk into your trading room every sunup with an extremely confident mindset make to take happening your opponents.

Trade with sound strategies and beliefs

In reality, markets can do 2 things, and if you're in a trade these two things result in a profit or loss; the market can go rising or information technology lav go out…pretty simple rattling.

Amazingly, traders over-think this, and the whole industry is organized to deceive you and taste to make you believe that trading is complex and sophisticated. Hence, the 'trick' is to have a scheme and belief organization that will be applicable to any marketplace, on whatever timeframe at any point in the future. You need to conduct analysis on a chart that is based on price, because if you can anticipate price movement you can net income from IT. Over again this is all quite logical really, and for some of you the penny has already dropped I Hope.

It's no orphic my trading career is built on studying and trading Price action, an unbelievably unlobed thus far immensely superhuman form of market analytic thinking which most of you already have a basic understanding of hopefully. Your beliefs in the market need to be logical just also simple. Atomic number 3 I have same, markets only burn up or down, so assume't make analyzing and trading them more effortful than it has to be.

It's actually everything 'in between' that causes traders to win or misplace. The stop loss placement, the entry price, the target area price, the emotional roller coaster, self-doubt, etc. The trading method really is only one part, so don't get caught up in finding the 'holy grail system', trust me, it does not exist.

If you can learn to read basic price action, understand how to plot Key levels connected charts and understand the national trend of a market, you are already happening-track to be in the top 10% because you're looking at the real market without the hazy goggles that your competition (other traders) are looking through. By combine this trading approach with the fundamental points we have discussed higher up, and applying yourself systematically, you standstill a chance in the jungle we call the market. If you want to start thinking and acting same the top 10% of successful forex traders, checkout my Professional person Trading Courses for more information.

Source: https://www.learntotradethemarket.com/forex-articles/how-to-10-percent-successful-forex-traders

Posted by: fosterfromed.blogspot.com

0 Response to "How To Be In The 10% of Successful Forex Traders - fosterfromed"

Post a Comment