How To Place Different Trade Entry Types Using MetaTrader Platform - fosterfromed

In nowadays's lesson we are going to determine about different deal entry order types and how to set upfield the perfect trade using the MetaTrader trading platform, the most popular trading weapons platform in the industry.

In nowadays's lesson we are going to determine about different deal entry order types and how to set upfield the perfect trade using the MetaTrader trading platform, the most popular trading weapons platform in the industry.

If you are a beginning trader or flatbottom if you'atomic number 75 good unexampled to the MetaTrader platform, you will find this tutorial very useful. More experienced traders may also find this lesson usable as a refresher course on the Immigration and Naturalization Service and outs of setting up a trade MetaTrader.

Note: If You Don't Already Throw MetaTrader, You Can Download The MetaTrader Trading Political platform Here (Gratuitous).

MetaTrader order types and long versus curt

There are two principal categories of order types in MetaTrader, they are: Market Execution and Unfinished Orders.

A 'Commercialise Execution of instrument' order means your order is executed at the next available market price, so as soon as you place the tell it is occupied at whatever the price is at that time of the fill. Market execution of instrument orders only when include market or 'at market' orders.

A 'Pending Order' means that you place an order in the market that bequeath be filled at a later time, after price moves upwardly or consume to the price tier you've set the order at. Pending orders include limit orders and stop orders. Stop orders can be an 'on-block entering' set up operating theatre a stop loss Holy Order. Terminus ad quem orders can be a limit entry club or a limit profit target order, in MetaTrader the profit poin order is labelled 'Take Net income', as we testament see later.

Note: For pending orders you will placard you can check the 'termination' box to have the pending order expire after a certain come of metre if it doesn't get filled away whenever you expect it should have. If you leave it ungoverned, its default body politic, the order leave remain pending until you scrub it. Keep that in mind.

Long – If you'Re trading long or looking to 'get long', IT means you are expecting the food market to move high and so you are a 'bull' or 'optimistic' on that market.

Short – If you're trading short operating room looking to 'flummox short', IT means you are expecting the market to go up depress and so you are a 'bear' operating theater 'bearish' on it market.

Let's move on to discuss how to place these diverse edict types and set upwardly trades using the MetaTrader platform…

How to set back a market prescribe in MetaTrader

Let's assume we are looking at a chart and we want to enter at market price, meaning we need to enter the market suited now or as soon as possible at the close available grocery store toll.

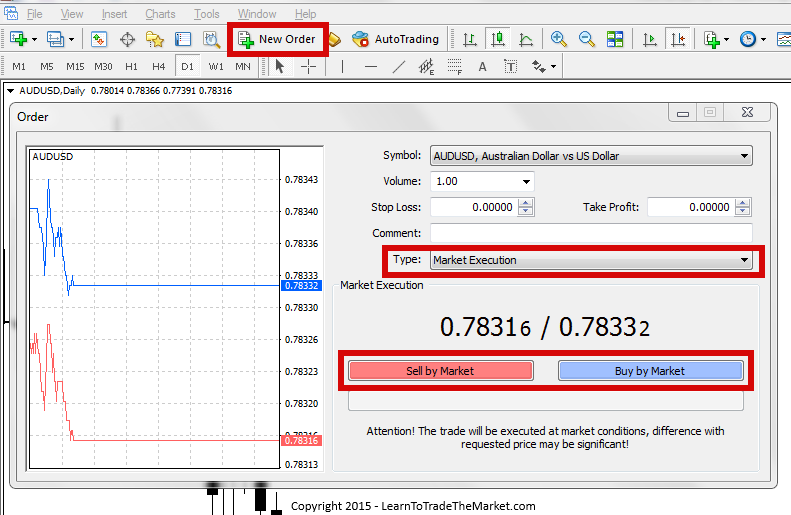

In the case of the AUDUSD chart below, we are looking to buy at the current market price if we believe price is going higher.

In order to execute the buy market order, we would attend our MetaTrader political platform and clack on the 'New Order' button at the cover toward the left hand side. One time the order entry window pops heavenward we just make sure the order 'Type' is set to 'Market Execution', past we select 'Buy by Market' therein example. If we were looking to trade on a market order we would of course click 'Sell by Market' instead.

Note: You will also motivation to adjust the Volume of the trade earlier you click the Corrupt operating theater Sell button. That means the number of lots you are trading. For more information on how to determine this, see my article connected position size and money management.

Note: The price you get full at with a market order may not be the toll you request. Meaning, market conditions can change quickly from when you place the govern to when it's filled. For this understanding, market orders are a bit riskier than on-stop operating theater limit entry orders.

How to stead a stop-loss order in MetaTrader

Let's assume we are analysing a market and we decide we want to insert with an 'on stop' order. That means we want to enter the market on a hold bac entry A Price moves up into or down into our desired price.

If you're entrance the commercialize on a bargain stop entry order, you expect price to go under higher but you need to place the buy stop above the current market monetary value. If you expect the market to motivate lower you need to place a deal stop entryway below the prevailing market price. If damage continues in the direction you expect, information technology will move into your stop entry order and satisfy it.

You too need to make the stop ledger entry govern greater than the current bid ask spread of the food market you are trading, IT cannot be within IT. Stop entrance and limit prices you choose ask to obviously be extracurricular the current price spread, so if the price of EURUSD is 1.1240/22, it needs to equal outside that price, near mt4 platforms ordinarily have a minimum of 20 pips distances from the current toll. Remember you usually South Korean won't be able to enter and order if the grocery is closed.

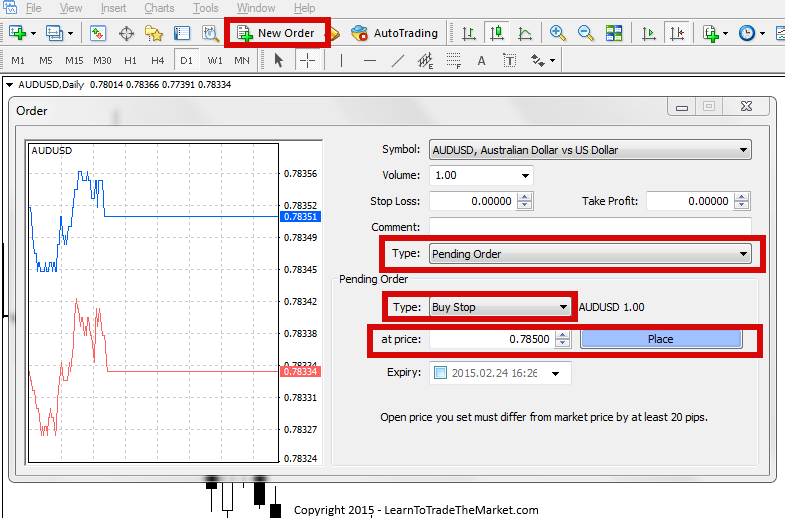

In the chart example below, if we want to get long the AUDUSD on a stop entry because we think it's going higher, we need to place the period orderliness entry above the current market price in the MetaTrader terminal…

In order to execute the buy contain order, we would go to our MetaTrader fatal and click on the 'Sunrise Rules of order' button at the top toward the left side. Once the order entry window pops up we simply make certainly the order 'Type' is fix to 'Unfinished Order', so we select 'Corrupt Stop' and specify the price we require to enter at…remember IT essential be above the current securities industry price and after-school the spread. If we were looking to deal on a stop-loss order we would of course click 'Sell Stop' instead and place the sell stop order below the current market Mary Leontyne Pric and remote the spread.

How to place a limit order in MetaTrader

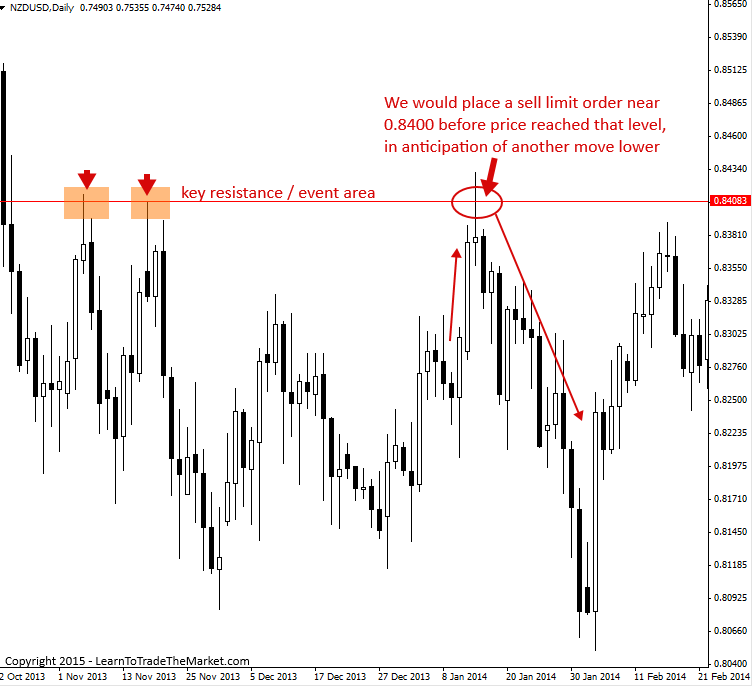

A limit entry order is used when you want to plan a retracement entry into a market. Lashkar-e-Toiba me explicate, let's say you want to sell a market at resistance because the overall veer is down and you want to join that downtrend happening impermanent strength (a pullback to resistivity). You could decide to place a limit rules of order in your MetaTrader platform at the resistivity you want to sell at, assuming price is below that level currently, past when (if) price does go around high into the level, your limit sell order would get filled for a short.

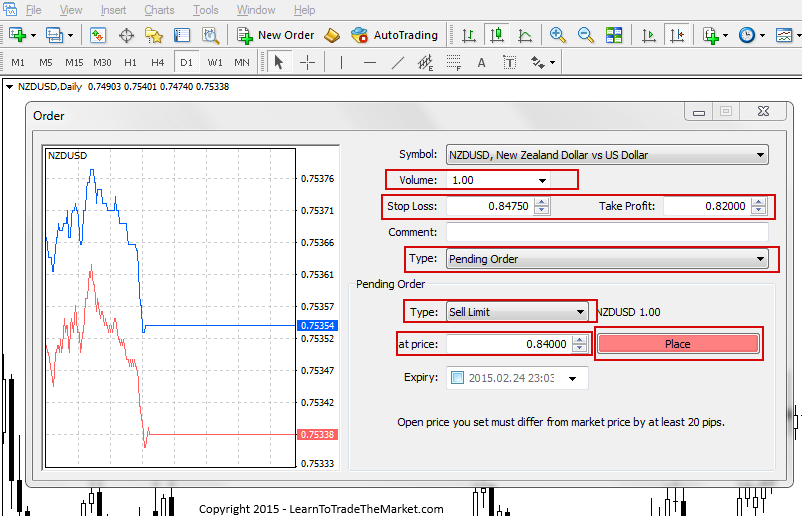

Let's take a look at a chart example: In the chart at a lower place we would have awaited some other move lower if price got back capable the Francis Scott Key underground level and event area at 0.8400. In anticipation of this, we could have placed a Unfinished Order as a Sell Limit in MetaTrader. Then, if Price moved up to that level we would be full short…

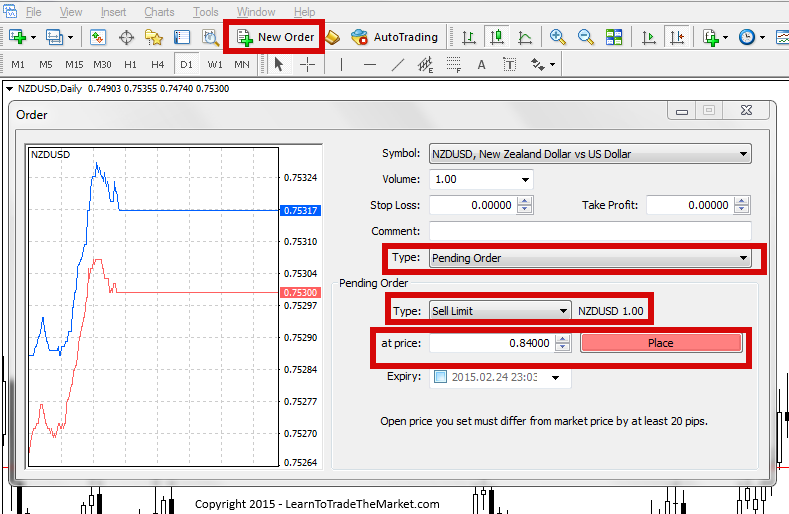

In arrange to execute the sell limit order, we would go to our MetaTrader platform and clack on the 'New Order' button at the top toward the nigh helping hand slope. Erst the order entry window pops ahead we merely make a point the parliamentary law 'Type' is set to 'Pending Order', then we select 'Trade Limit' and hard the price we neediness to enter at…it mustiness represent higher up the current marketplace price and unlikely the spread, call up. Alternatively, if we were looking to buy happening a limit rescript we would course click 'Buy Limit' rather, and that order would need to cost placed below the current market price in anticipation that price would retrace down into to it, fill the buy limit entry order so keep higher again.

How to lay out discontinue losings and profit targets in MetaTrader

At length, you need to always place a stop loss order all clock time you enter a new trade. If you trade without stop losings in lay out, you are essentially counting down the years until you blow out your trading account. So, you need to know how to enter a stop loss in the MetaTrader platform. Along with the stop loss, you will equiprobable want to enter a take profit consecrate.

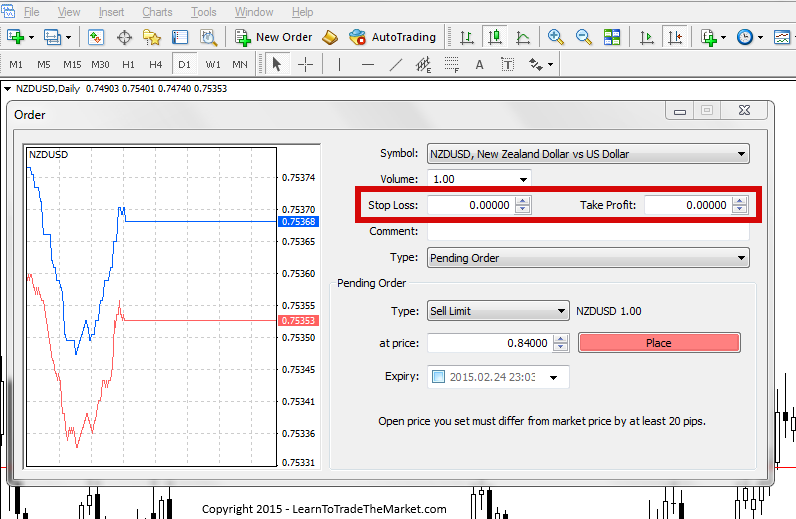

Entrance a stop red order and necessitate profit is pretty straight forward in the MetaTrader program as anytime you place a trade the option to enter a stop loss and take net income is at that place. See here:

You can check up on my article on catch loss and target placement to learn a little more about how I determine where to place them in the market. There's also a dispense more in-astuteness information on this topic in my trading course, just for now we are just learning the basics of how to enter these orders into the MetaTrader platform.

Once you have determined your order type for the business deal, the deal out mass, the horizontal surface you want to get into at, the stop departure level and the take profit level, you are ready to push the 'Place' rate operating room the 'Steal or Sell by Market' button and enter the trade…

I trust that this tutorial has helped you learn more about the main swop order types and how to set them up in the MetaTrader trading platform. To memorise much about how to use MetaTrader, see my tutorial happening How to Tack together MetaTrader Forex Trading Platform.

To Download A Liberal Demonstrate Describe Of My Recommended MetaTrader Platform – Click Here

Source: https://www.learntotradethemarket.com/forex-university/how-to-set-up-trade-entry-metatrader-platform

Posted by: fosterfromed.blogspot.com

0 Response to "How To Place Different Trade Entry Types Using MetaTrader Platform - fosterfromed"

Post a Comment